I’m not stating that do not own any a property on your IRA. There will well be situations where it’s wise to own a great fraction of your own society. Possibly. However, toward overwhelming greater part of you around, it isn’t best.

This new proponents from having a property on your own IRA constantly give you as possible very own their a house in a taxation-advantaged account, which can be perhaps not untrue. But not, whatever they Usually do not show is really what I simply laid out to you personally in this article.

If you are IRA’s was tax-advantaged for a while, they become a liability and a prospective income tax trap afterwards. And, just like the Internal revenue service is actually smarter than just most people give them borrowing getting, they’ve generated holding a house from inside the a keen IRA more off an inconvenience than just it’s worthy of.

It’s also important to remember that IRAs do not make the most of a step-right up when you look at the basis when handed down. All the dollar that comes from an enthusiastic IRA try taxed because ordinary money due to the fact money in the newest IRA is not taxed. And you will Buddy is sick and tired of wishing toward his tax currency.

This new Safer Work Altered Things As well

As well as, non-spouse beneficiaries no more manage to increase an IRA more her lifetime. One went out on the Secure Act.

The fresh new Secure Work plus says that the IRA should be emptied within this 10 years of your own IRA customer’s dying, making certain that the whole IRA might possibly be at the mercy of typical money fees within this 10 years, and you will, almost certainly during the a lot higher costs than simply whether your continue were still in place. It’s an earn to have Uncle sam and you may a giant losses to own the non-lover beneficiaries off a keen IRA.

Step-back and you will Consider your State

Thus, if you are provided with your IRA to invest in a good team or home of any sort, We implore that reconsider that thought. Cannot put a secured item that accompanies a whole machine regarding tax experts on an account that comes with an entire server regarding income tax disadvantages!

It really will not create financial sense until, that it is, you are the one earning profits installing it tax trap with the naive.

Agenda Free Visit

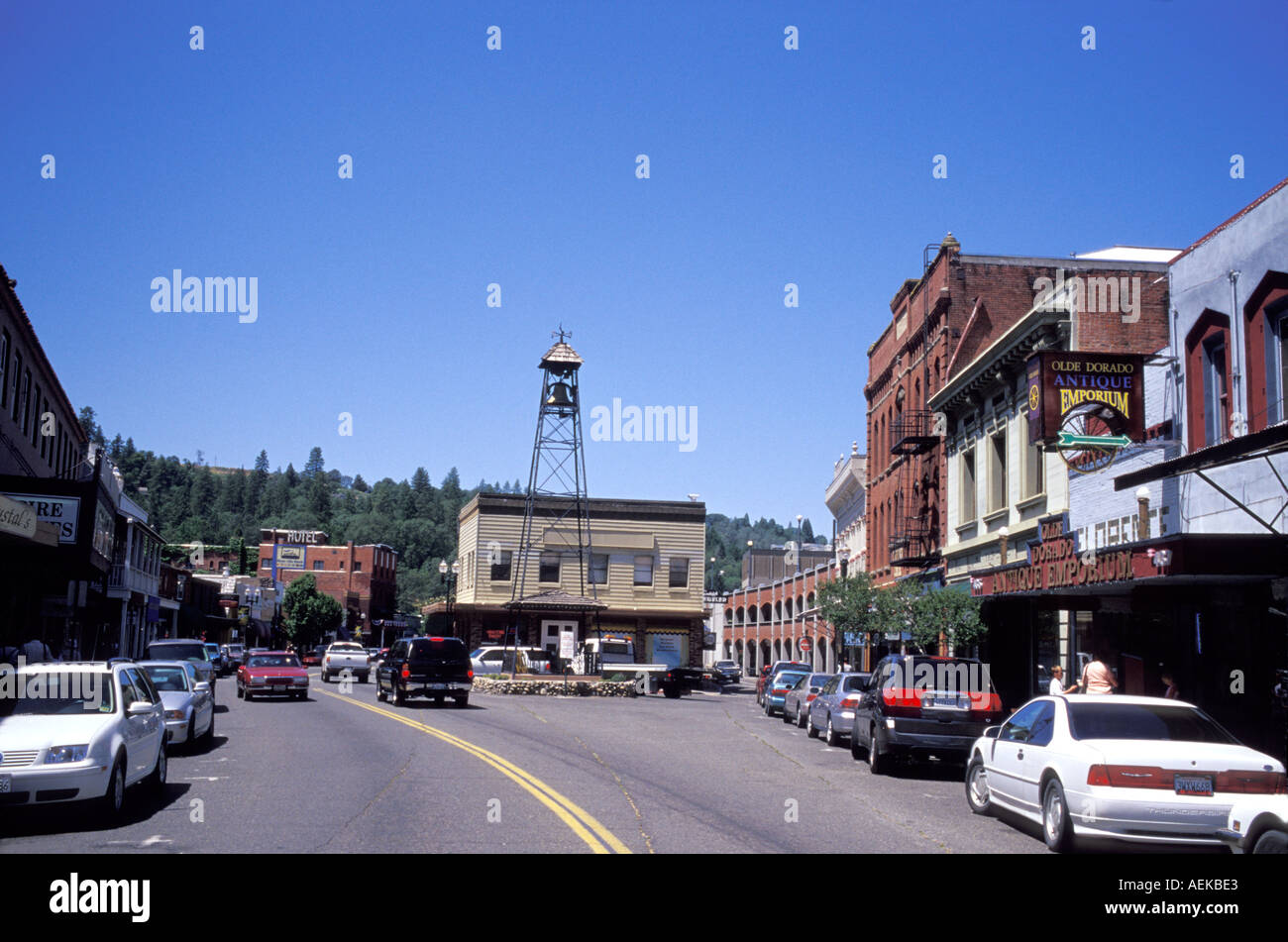

Discover office you’d like to speak to. We are able to satisfy inside the-person, by the digital meeting, otherwise of the cellular telephone. It is merely two points in order to plan a period getting your own No-cost Appointment.

The fresh feedback conveyed depict new opinion of modern Wealth Administration a keen SEC Joined Financial support Advisor. Recommendations offered is actually for illustrative purposes only and will not compensate resource, taxation, otherwise no checking account payday loans Pine Apple legal advice. Modern Riches Administration will not take on people liability towards the use of your own advice discussed. Consult with a qualified economic, legal, otherwise income tax top-notch before taking any step.

However, even with old-age, because you remove it immediately following 59 and a half, it’s subject to average income tax. Better, a residential property by itself can have some favorable taxation therapy. You have made some depreciation thereon a home so you can counterbalance specific of the income this renders.

Dean Hairdresser: Look, if you would like talk about the advantages and disadvantages off real estate, or if you need the next opinion of a good Certified Financial Planner here at Modern Wide range Government.

Dean Barber: It’s just little bitty such things as you to definitely, Bud, that cause us to step back and say, Why would I really do you to definitely?

To ensure that interval loans feels as though a common loans. Its slightly more, nonetheless it can be own private home, and it will own in public areas-exchanged REITs, and it is liquid. Ok. In the event the home ends up to not become place we wish to be, we are able to sell, so we will perform something different in it.

Dean Hairdresser: Proper. And when you really have an effective strong clients, the fresh new tenants will pay one loans regarding. Thereby this is when you have made the latest multiplying impression.

Progressive Profile Idea

I do believe that was the part which you generated, Dean. I visited observe that rotation going on, therefore certainly will continue to take over immediately.

As soon as we understand what that is, we generate that portfolio designed to provide where you wanted to go with at least level of risk you are able to. And after that you build changes in the process Bud, you’ve made adjustments to your portfolios over the last 12 months to suit your website subscribers.

A few expenditures some belongings they like to possess $100,000. It hold onto it the rest of the life, and hop out the new home to their heirs on their passage. Let’s say, in the interests of this situation, the belongings one to begin with cost the couple $100,000 has started to become worthy of $five hundred,000.

What if it is accommodations?

Offer new equipment or the business equipment to really make the payment? You can’t spend the money for RMD from your pouch. Brand new IRA must shell out it. Just remember that , if you don’t take your RMD, the fresh new punishment are 50% of number you should have removed, also you have still got to take they to the year your missed while the latest seasons. Discuss raining salt to the an injury.

Αφήστε μια απάντηση