To elaborate, it measures how much a company’s operating income will change in response to a change that’s particular to sales. Scenario planning becomes more straightforward with the DOL calculator at your disposal. Assess different scenarios by adjusting sales volumes and costs to see how your operating income would be impacted. After calculating the leverage by applying the formula, if the result is equal to 1, then the operating leverage indicates that there are no fixed costs, and the total cost is variable in nature. The enterprise invests in fixed assets aiming for the volume to produce revenues that cover all fixed and variable costs.

Degree of Operating Leverage Calculator

This article explores the Degree of how to manage accounts receivable, providing insights into the formula, how to use it effectively, an illustrative example, and answers to frequently asked questions. In the base case, the ratio between the fixed costs and the variable costs is 4.0x ($100mm ÷ $25mm), while the DOL is 1.8x – which we calculated by dividing the contribution margin by the operating margin. The contribution margin represents the percentage of revenue remaining after deducting just the variable costs, while the operating margin is the percentage of revenue left after subtracting out both variable and fixed costs. The Operating Leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs. The Degree of Operating Leverage (DOL) indicates how sensitive a company’s operating income is to changes in sales volume.

Telecom Company Example

In the world of finance, the Degree of Operating Leverage is a key metric for assessing a company’s financial resilience and profit potential. One concept positively linked to operating leverage is capacity utilization, which is how much the company uses its resources to generate revenues. Increasing utilization infers increased production and sales; thus, variable costs should rise. If fixed costs remain the same, a firm will have high operating leverage while operating at a higher capacity.

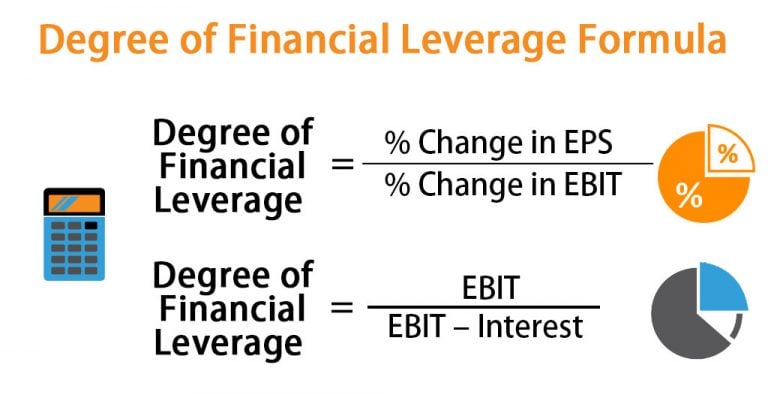

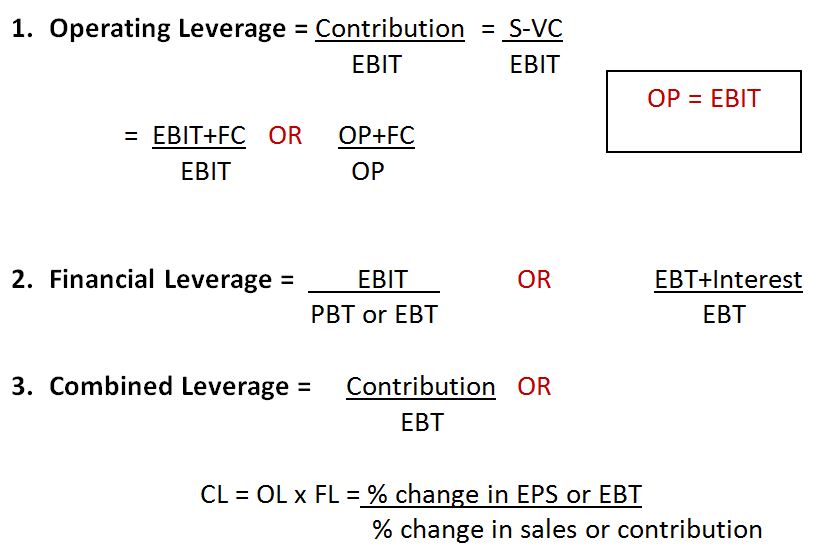

Operating leverage vs. financial leverage

- High DOL values suggest potential for increased profits but also increased risk, while low DOL values imply stability but limited profit growth.

- Or, if revenue fell by 10%, then that would result in a 20.0% decrease in operating income.

- The DOL is calculated by dividing the contribution margin by the operating margin.

The Degree of Operating Leverage (DOL) is a critical financial metric, offering insight into how a company’s operational income is affected by fluctuations in sales. It essentially highlights the sensitivity of a company’s earnings before interest and taxes (EBIT) to changes in its sales volume. Variable costs decreased from $20mm to $13mm, in-line with the decline in revenue, yet the impact it has on the operating margin is minimal relative to the largest fixed cost outflow (the $100mm). From Year 1 to Year 5, the operating margin of our example company fell from 40.0% to a mere 13.8%, which is attributable to $100 million fixed costs per year. However, companies rarely disclose an in-depth breakdown of their variable and fixed costs, which makes usage of this formula less feasible unless confidential internal company data is accessible. On that note, the formula is thereby measuring the sensitivity of a company’s operating income based on the change in revenue (“top-line”).

We will discuss each of those situations because it is crucial to understand how to interpret it as much as it is to know the operating leverage factor figure. By calculating your DOL and comparing it with industry benchmarks, you can assess your business’s efficiency and competitiveness. A DOL higher or lower than industry standards can indicate areas for improvement or potential strengths. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

By calculating the DOL, you can identify areas where cost reductions can have the most significant impact on profitability. Use the calculator to pinpoint cost control opportunities and streamline your operations. Since profits increase with volume, returns tend to be higher if volume is increased. The challenge that this type of business structure presents is that it also means that there will be serious declines in earnings if sales fall off. This does not only impact current Cash Flow, but it may also affect future Cash Flow as well. One important point to be noted is that if the company is operating at the break-even level (i.e., the contribution is equal to the fixed costs and EBIT is zero), then defining DOL becomes difficult.

Here’s how you can use an Operating Leverage Calculator to understand how your company’s fixed and variable costs impact profitability. The calculator will provide the DOL value, which indicates the sensitivity of a company’s operating income to changes in sales volume. The DOL essentially measures how sensitive a company’s operating income is to fluctuations in its sales volume.

DOL helps investors assess the potential risks and rewards of a company’s cost structure, giving insights into how changes in sales might impact profitability. Consider a company with fixed costs of $500,000, variable costs of $2 per unit, and selling price of $10 per unit. The company’s overall cost structure is such that the fixed cost is $100,000, while the variable cost is $25 per piece.

Αφήστε μια απάντηση