step 1. Check your borrowing

Every piece of information on that declaration might help you when you talk with their home loan manager. It’s a good idea when deciding to take a review of the credit once most of the one year to make sure there are not any inaccuracies on your declaration.

2. Score home loan pre-approval

2nd, choose which mortgage product is a knowledgeable complement your circumstances, upcoming shop more lenders observe the one that gets the finest words. Home loans can be for example helpful here, simply because they work at some lenders, and you can shop your loan to find a very good price.

Attain your specialized pre-recognition letter showing providers you are a life threatening buyer, you’ll want to reveal these types of documents:

- Two years from W2s

- Pay stubs over the past a few months

- Financial statements for the past a couple months

- Two years property value taxation statements

- Profit and loss comments having thinking-functioning somebody

- Personal bankruptcy or separation and divorce files (if the relevant)

Obtaining the pre-recognition letter is a crucial part associated with the techniques. It will make people offers you make towards the prospective belongings way more effective, because signifies that debt details have previously met the latest minimum conditions necessary for your own financial, and barring any challenge throughout the underwriting, you will probably be acknowledged for capital.

step three.Discover a realtor

See good real estate agent that is competent within performing that have very first-day people in your area. Your own large financial company frequently works together with many different agencies, which is well-versed on which ones know your address area most useful. Very first time customers, veterans, and you will large-stop homebuyers tend to understand this version of expertise in negotiating deals.

cuatro. Restrict where you are

In the long run, beforehand searching, restrict the space we should reside in. Thought activities influenced by venue such as for instance:

- distance to get results

- just how close youre to the features you prefer

- top-notch the local universities (even though you lack students)

- upcoming developments or town thought

5. Pick your next household

Incorporate a property programs and other helpful devices so you’re able to stay structured, and you may search home values in the area. Think of, that is most likely not the very last domestic you’ll own. It is a-start, and you can a means to create your next collateral to your.

Keep real estate need compared to. wishes record planned whilst you shop, to help you optimize your to acquire energy and keep maintaining requirement inside consider.

6. Make a deal

Once you get a hold of a property you love, your representative will assist you to create a deal. The deal will state your terms towards home pick, the type of financing you’ll play with, and you may any supplier concessions you’re requesting.

Your agent makes it possible to decide if it is smart to query having seller concessions, incase it’s better to go away all of them away, with respect to the temperatures of the market, top personal loans New York and you may quantity of almost every other offers the home may have.

Owner upcoming has got the solution to take on, deny or give an excellent counteroffer. Tend to might get back and you will forth from time to time that have owner before you can visited a contract.

seven. Their bring try acknowledged

When you and also the provider come to an agreement as well as your provide was commercially approved, youre considered in the package.’ You’ll lay a date in order to to remain the fresh dotted line and romantic the offer.

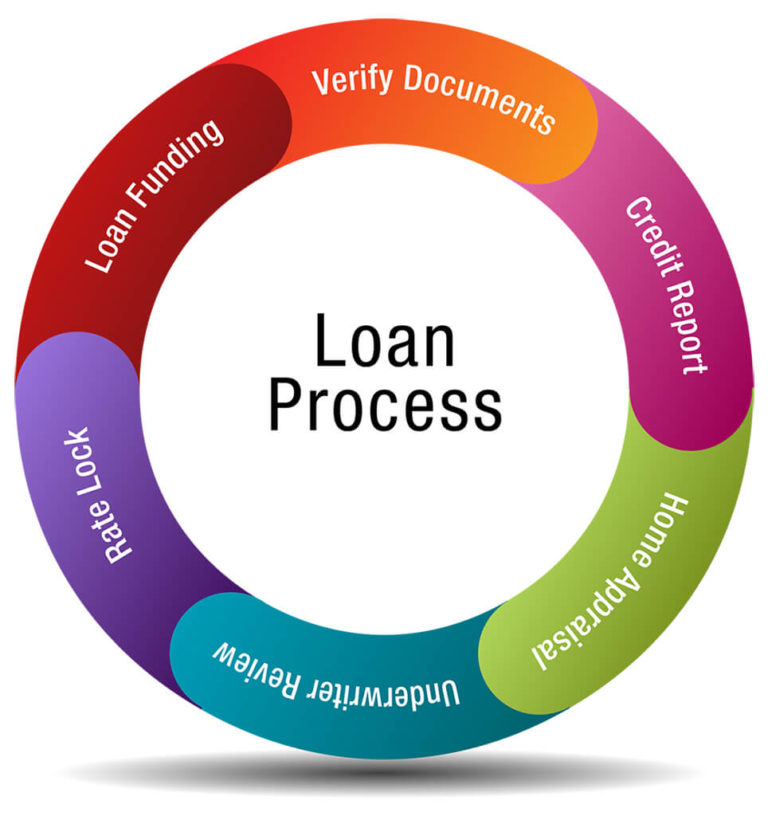

8. Mortgage underwriting and you can Inspections

The time has come to possess underwriting, appraisals, and checks. There are many ready during this time period, also it may seem like nothing is happening sometimes, however, much is happening behind-the-scenes to-drive your loan through.

TIP: Pose a question to your home loan coach about the do’s and you can don’ts out-of escrow, so you dont affect sabotage your home mortgage through a beneficial disperse your own financial would not approve out of.

9. Romantic escrow

Since the closing date nears you are going to give money to possess one closing costs and deposit required by their lender, and you will indication the state documents when planning on taking possession in your home.

Once you signal the borrowed funds documents with an effective notary, the financial often see one history remaining criteria and then your document could be put-out to list into the state. While the file is filed to your county, youre theoretically a homeowner!

10. Schedule an appointment.

It is as easy as arranging a quick name or interviewing a financial advisers. In a few minutes, you’ll know what you can afford, and how to go-ahead.

Αφήστε μια απάντηση