Clients don’t know just what their best price have a tendency to be when they indication the contract. This new preparations are repaired annual purchase price grows as high as 5%. However, Household Couples and passes to the their closing costs and something entitled “make-in a position costs” towards house. While you are renters located cost quotes before signing, clients usually do not learn the latest “make-ready” can cost you until immediately after closure.

The theory is that, the latest “make-ready” will cost you tend to be merely clean up and you will renovations needed to make house habitable, together with unique needs on occupant. However tenants informed Insider they ended up with a substantial price and little explanation.

One to Georgia occupant requested drapes, a bath home, in addition to fix from a hearth submit for an excellent 15-year-dated house she told you is if you don’t in “immaculate” updates. She asked the balance to get to only about a good pair thousand bucks; Family Couples added nearly $17,000 to their unique price and you may refused to provide their unique an itemized dysfunction.

Your house Partners representative rejected the business doesn’t believe customers’ power to rating a mortgage and you can told you the company explores customers’ debt-to-income ratio and you can takes strategies to aid renters bolster the credit

Whenever Domestic Partners bought Hines-Denson’s Atlanta-area home having $270,000 inside the cash, she knew their own cost manage go up on a yearly basis. However, she recognizes one she failed to check out the very long agreement so you can the finish. The past web page, she found later on, told you their own purchase price manage immediately dive by nearly twelve%, to help you $302,3 hundred, because the businesses closing and you can purchase will set you back was additional towards the. That’s the rates she would need to pay to your domestic while in the the initial seasons off their own rent, away from , an occasion when average domestic-purchases rates in her own condition flower by 3.3%, predicated on analysis provided by Redfin, a national real-home broker. That walk risked pushing her cost above the house’s analyzed value – and you may minimizing their own likelihood of qualifying to own home financing.

Hines-Denson, today 43, located after their particular advance amererica cash advance circulate-in this their female household was full of dilemmas. The electric shops regarding the upstairs bedrooms don’t functions, while the downstairs of them eliminated doing work, also. The household finished up stringing an extension wire out of a working socket on yard to perform the indoor equipment. Hines-Denson, a nursing assistant, said she and her spouse, a truck driver, wound-up expenses regarding the $step three,000 to have an electrician rewire the house just after a maintenance go to don’t resolve the problem and further requests so you’re able to Family Partners was ignored.

The couple failed to care and attention continuously about the costs at the big date, because they still wanted to choose the home. Until the first year of their rent is actually up, they’d already begun conversations that have mortgage lenders. They were every discouraging. Nevertheless they wouldn’t qualify for that loan large enough to pay for the latest $317,000 purchase price the contract had jumped so you can on the lease’s next seasons.

A dream ends in eviction

Previous employees accustomed the business’s underwriting techniques told Insider and you can new McGraw Heart that when Household Lovers establishes extent it have a tendency to spend to invest in property for an occupant, it considers just good tenant’s capability to shell out monthly lease. It does not gauge the tenant’s capability to be eligible for a mortgage in the highest costs cooked to the bargain.

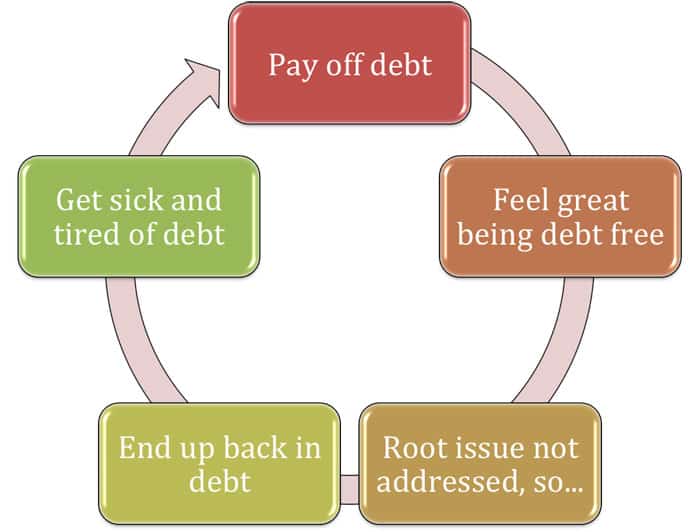

This new expanded tenants try buy, the greater they have to spend – meaning renters who are in need of a few years to solve its credit otherwise help save to have a down-payment are at a significant downside.

Immediately after being refused having home financing within the season a couple of, Denson sustained a debilitating coronary arrest. Hines-Denson was required to reduce their instances in the office to care for him, in addition to couple’s economic stress mounted. Inside , they missed a rental payment.

Αφήστε μια απάντηση