HUD-stored money is finance which were originally covered of the HUD , consequently they are now owned by HUD alone. HUD-kept money differ than simply HUD-had services, because these are services the spot where the term of the property is actually stored from the HUD because of a borrower foreclosures.

HUD-held fund is actually financing which were to begin with insured of the HUD, and tend to be now belonging to HUD alone. HUD-kept finance are different than simply HUD-had characteristics, since these is characteristics where in fact the term of the house is becoming held by the HUD as the result of a debtor foreclosure.

What is actually an effective HUD-held loan?

A good HUD-stored mortgage was a keen FHA-insured financing that is today owned by HUD. Usually, this occurs when a borrower possess defaulted on their financing and you can HUD chooses to choose the financing on the financial. Oftentimes, HUD will give loans provider relief to your property for a certain time frame, when you are creating a work-aside want to balance out the property financially.

HUD-Kept Money when it comes to FHA 232 Capital: A HUD-held property is a house which have an FHA-insured loan that’s now belonging to HUD. This may allow borrower to increase specific benefits. However, good HUD-possessed property is one out of which the title could have been given to help you HUD, usually because of a property foreclosure.

HUD-Held Fund in addition to HUD 221(d)(4) Mortgage System: Good HUD-kept financing is an earlier FHA-insured financing that is today belonging to HUD. So it constantly is when a borrower has foreclosed toward financing together with term might have been relocated to HUD.

More resources for HUD multifamily design financing such as the HUD 221(d)(4) mortgage, fill in the shape less than and you can a great HUD credit pro often be connected.

How does an excellent HUD-kept loan functions?

A great HUD-kept loan are an enthusiastic FHA-insured loan that’s today belonging to HUD. Generally, this happens whenever a debtor provides defaulted to their mortgage and you will HUD decides to choose the mortgage regarding the bank. Oftentimes, HUD will give obligations provider relief to the property to possess a beneficial certain time, while you are starting a-work-aside propose to stabilize the property financially. HUD-stored fund is also pertaining to FHA 232 funding, the spot where the borrower is obtain specific masters. However, a good HUD-possessed property is one in that your identity might have been provided to HUD, always because of a foreclosure.

More resources americash loans Mooresville for HUD multifamily build financing like the HUD 221(d)(4) loan, fill in the shape lower than and a good HUD credit specialist commonly be connected.

Exactly what are the benefits of a beneficial HUD-held loan?

An excellent HUD-held mortgage provide particular advantageous assets to the brand new borrower. These benefits become debt services recovery, as the HUD might provide debt service relief towards the property having a specific period of time whenever you are starting a work-out want to stabilize the house financially. In addition, HUD-kept fund also provide use of the newest HUD 221(d)(4) financing system, which provides enough time-title, non-recourse, fixed-rate funding towards the framework or good-sized rehabilitation off multifamily properties. For more information on HUD multifamily design financing including the HUD 221(d)(4) loan, fill out the design below and a HUD credit expert have a tendency to link.

Which are the threats of this an effective HUD-held financing?

The dangers associated with an effective HUD-kept financing are the possibility of brand new debtor in order to standard into the the loan, which could lead to HUD taking possession of the house. At exactly the same time, HUD might provide financial obligation service save with the property to possess an excellent particular period of time, if you are doing a-work-away propose to balance the house economically. This might end up in an extended fees period, that will improve the threat of default.

Do you know the criteria for obtaining a HUD-stored financing?

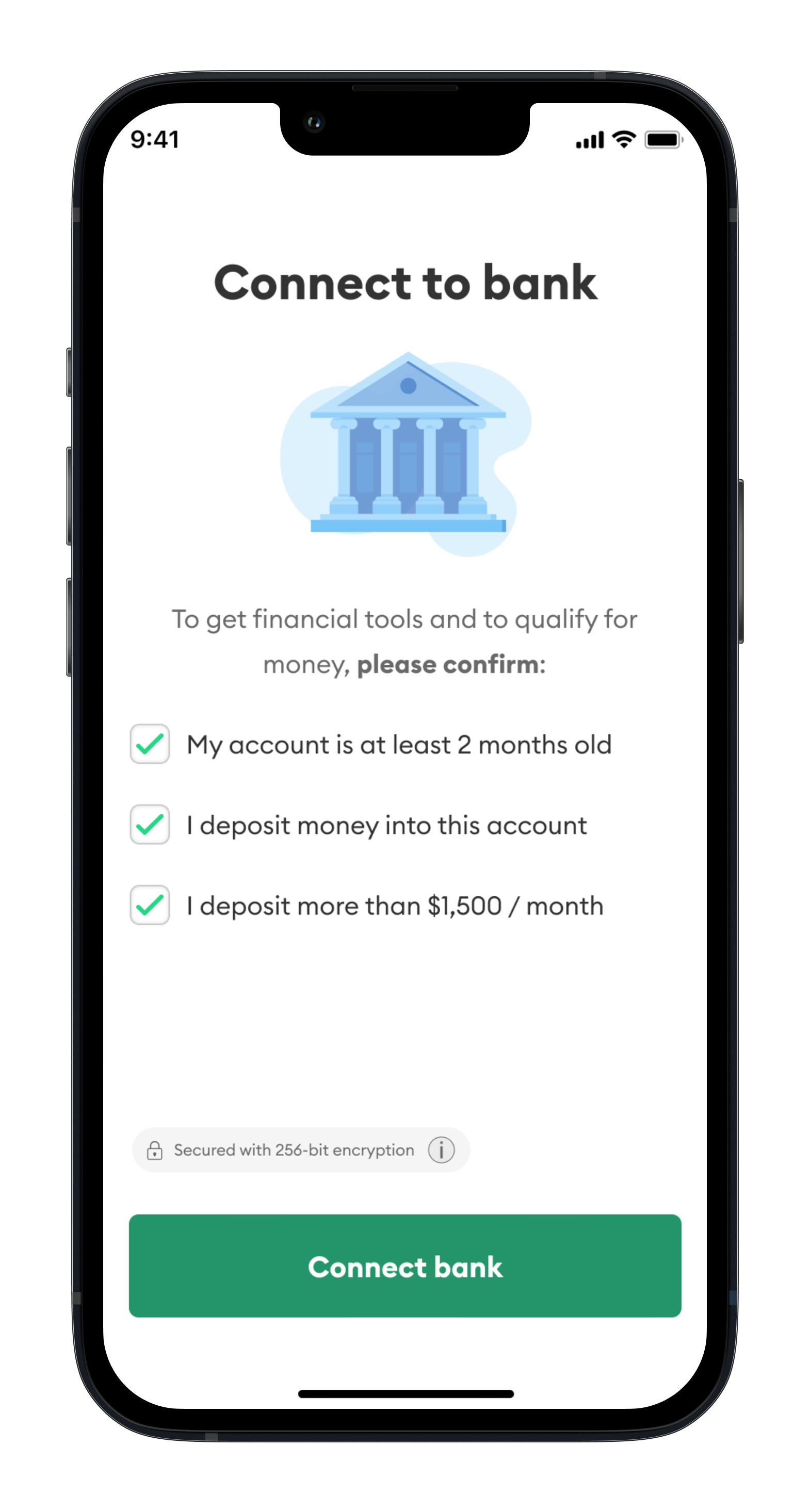

So you’re able to get an excellent HUD-kept loan, a debtor need to typically have sense properly doing work one or more establishment of the same form that they want to build or get. While doing so, a debtor should feel arranged as the one house, special purpose entity (SPE). Eligible consumers can either feel a for-profit or a low-finances organization. The house might also want to feel covered by possessions and you will responsibility insurance rates in the course of the loan, in addition to first year’s premium should be paid-in full at closing. Additionally, borrowers should provide their lenders which have proof of insurance policies to your or until the closing time otherwise until the policy’s revival date.

Janover: Your ex in Progress

On Janover, you can expect many services customized on the book needs. Of industrial property loans and LP government so you’re able to loans and you will functions for lenders, the audience is here so you’re able to enable it to be.

This great site is actually belonging to a friends that offers organization recommendations, suggestions or any other functions connected with multifamily, industrial home, and organization resource. You will find no affiliation having any authorities institution and are maybe not a loan provider. We are a technology providers that utilizes application and you may sense to provide lenders and consumers to each other. Making use of this website, you commit to our very own access to cookies, our very own Terms of use and the Privacy. We play with cookies to offer good experience and you will to help the web site manage effectively.

Freddie Mac and you may Optigo is registered trademarks away from Freddie Mac. Fannie mae is an authorized trademark from Fannie mae. We’re not connected to the new Agencies out-of Houses and you may Urban Invention (HUD), Government Houses Management (FHA), Freddie Mac computer otherwise Federal national mortgage association.

This great site utilizes phony cleverness innovation in order to vehicle-build answers, that have restrictions in precision and you may appropriateness. Users should not trust in AI-generated posts to have definitive information and you will instead is confirm activities or demand pros of one private, courtroom, financial or any other matters. The site proprietor isnt guilty of injuries presumably due to entry to this site’s AI.

Αφήστε μια απάντηση