Building work inside breastfeeding, definitely, includes a lot of pros. Besides providing you with the opportunity to let somebody and you may help save lifestyle everyday, getting a nursing assistant provides you with a quantity of occupations safety that is hard to find into the tremendously concert-centered cost savings.

Also, this new nursing occupation offers tremendous freedom one to pulls many people just who want to venture into which career road.

Even with these types of pros, the new nursing industry certainly has its great amount of drawbacks, particularly when considering mortgages. Overall, mortgage brokers choose individuals who fit nicely from inside the 8-5 work course which have constant and consistent shell out monthly and you will couples a job holes.

In this line of performs, employment openings are definitely the standard as opposed to the exemption and most operating days are essential “overtime.” That isn’t the fact when you are an employee nursing assistant and you may so much more in order a moving you to definitely.

On account of these types of reasons, securing a mortgage due to the fact a nurse can be a very daunting processes. But that does not immediately imply it is impossible.

Despite your debts and dealing plan, you could nonetheless qualify for and start to become accepted for a mortgage financing for folks who weighing the options and choose appropriately.

Must i Get A mortgage loan Due to the fact A staff Nurse?

Given that before emphasized, this new medical industry has actually a unique band of factors that can make protecting a mortgage more complicated versus almost every other specialities. It is still you can to obtain home financing considering you can make proof a career and you will money when applying for brand new mortgage.

Here are a few of products that you need to feel familiar with when applying for a home loan due to the fact a staff nursing assistant:

Earnings

Among the many points that lenders typically look at whenever being qualified a mortgage application for a financial loan is their income, and you will personnel nurses are not any exception to this rule.

Truly the only distinction is the fact nurses provides various types of income that they must account for in their financial software. Talking about:

Legs Pay

While the a registered nurse (RN), you need to use their ft shell out since qualifying income when applying having home financing because you start working, even though you just have has just graduated. Mortgage brokers requires you to have been in productive a job for a couple of years in order https://paydayloancolorado.net/florence/ to qualify for a mortgage using your ft spend.

With that said, lenders may look at the date you spent for the medical university as part of your work background. Because Rn education is actually longer than 2 yrs, your own lender often think your given that having satisfied minimal several-seasons functions records specifications once you begin your first go out on your nursing community.

Consequently, when obtaining an interest rate, their lender may need that bring their employer’s give letter stipulating their legs income and amount of instances you will be questioned to the office.

Change Differentials, Overtime, and other “Extra Spend”

If you learn that the legs pay is not enough to afford you the amount of household you are looking to acquire, care and attention maybe not. You can nonetheless make use of move differentials, overtime, or other even more earnings so you can qualify for a home loan at exactly the same time towards the feet spend.

Lenders constantly clean out change differentials once the adjustable money and you will think they section of the complete earnings whenever being qualified your getting a great home loan. They are going to want to see their change differential money records (of ranging from several to help you two years) once you get home financing.

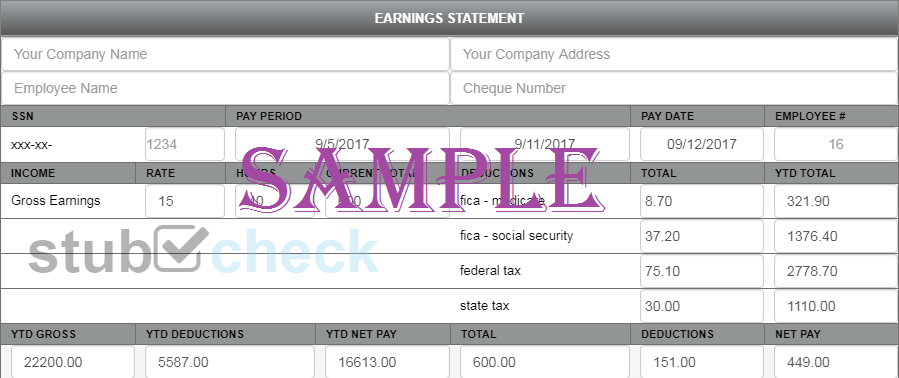

So, guess you’ve been functioning specific night shifts to the other days most of the week for two age with a change differential salary off $ten and have now plus worked overtime for the some days; we have found a report about how your mortgage lender you will determine your revenue.

Αφήστε μια απάντηση