Common types of intangible assets include brands, goodwill, and intellectual property. Businesses have several ways to value these assets, which can be challenging because they have no shape or form. They are in contrast to tangible assets, which have physical forms and can be held. (b) Internally generated intangible assetsThis is where the standard starts to get a little controversial.

An example calculation of the amortization of an intangible asset

Businesses commonly use marketing, design techniques, and advertising to come up with their brands. For instance, most people can easily identify Apple (AAPL) just by seeing its logo. “My understanding [is that the] Banking Association [believes that] based on the standards [set by the BOJ], that there is a limitation as to the extent to which they can accept assets or collateral that would be acceptable under SIPPA. Instead, you should revise the asset’s useful life at the end of each financial year and seek for the indicators of impairment.

Which Intangible Assets Are Amortized Over Their Useful Life?

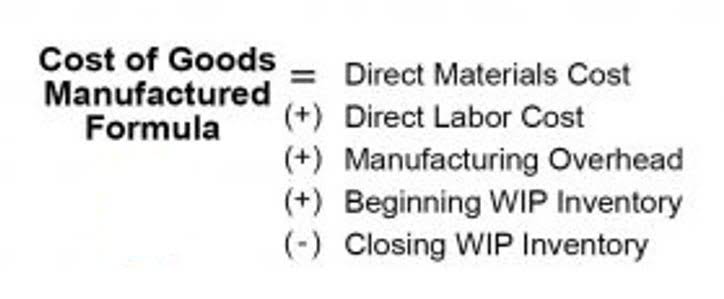

Amortization is the process of gradually writing off an asset’s initial cost, and it only applies to Intangible Assets. It’s calculated by taking the difference between the asset’s cost and expected book value and dividing that figure by the total years of use. There is no salvage value at the end of an intangible asset’s useful life. You need to recognize various types of intangible assets if they meet the following criteria. This is irrespective of whether you purchase or self-create such assets. Tangible and intangible assets can benefit your business come tax time, too.

Journal Entry for Intangible Assets With a Limited Life

- However, there exist additional criteria for self-created or internally generated intangible assets.

- Figure 4 shows the gap for the health-care sector, as an example, using only R&D as the measure of intangibles, and the roughly equal shares explained by intangibles and market power.

- The formula that top growers have apparently hit upon may help other businesses to understand the best way to invest in intangibles and deploy them, and help policy makers to put in place the right kinds of enabling infrastructure.

- For intangible assets though, it’s much more common to have an asset than should not be amortized.

- The difficulty in providing valuations from secondary markets, rapid and uncertain depreciation, and the potential for unexpected obsolescence all contribute to the measurement challenge.

- This expense is simply the cost (purchase price) divided by its useful life.

Goodwill is a common result of acquisitions where the purchase price is greater than the fair market value of the assets and liabilities. Each year, the net asset value for the software will reduce by that amount and the company will report $3,333 in amortization expense. The mechanics of the amortization calculation are otherwise the same as calculating depreciation with the straight-line method. The company should subtract the residual value from the recorded cost, and then divide that difference by the useful life of the asset. If you need an accounting software platform, consider giving SoftLedger a try. Depreciation too spreads out the cost of the asset over its useful life.

Intangible Assets Balance Sheet

Top growers invest 2.6 times more than low growers in intangibles, invest in the four major types of intangible asset, and deploy them effectively with a focus on embedding intangibles in day-to-day business operations to achieve returns. Investing in a new store is fairly straightforward for a retailer with relatively certain prospects for sales. However, the sales boost from investing in, say, a real-time promotion platform is less certain.

(c) Without physical substanceTo keep it simple, the items covered under IAS 38 are items you cannot touch and are often technology-based. Therefore, this can include brand names, development costs related to research and development, patents, goodwill and similar items where all the company may physically hold is a legal document rather than a physical item. IAS® 38 Intangible Assets is one of the key standards in the Financial Reporting (FR) exam, covering how companies should account for intangible assets. A well-prepared candidate needs to be able to understand and explain the key principles of the standard, in addition to preparing calculations.

Journal Entry and Reporting

Accounting and reporting for crypto intangible assets – KPMG Newsroom

Accounting and reporting for crypto intangible assets.

Posted: Tue, 26 Mar 2024 00:38:37 GMT [source]

Αφήστε μια απάντηση